Student loan forgiveness is an option that you should consider. While there are many different programs, a student loan forgiveness program could help you pay off your loan faster and still can continue paying for school. The question is, is this legit?

Is the Student Loan Forgiveness Center Legit?

Many student loan forgiveness programs are available to help you pay off your student loans before they become a burden. However, it’s important to remember that not all of these programs are legitimate.

Yes, the student loan forgiveness center is legit. They have a good reputation for helping students with their student loans and offer many different ways to pay off your debt.

The student loan forgiveness center will help you find the best way to pay off your debt. They can help you with your federal and private loans by helping you determine how much you should pay each month and how often you should do it.

They also offer other services, such as counseling and financial planning to help people who have trouble paying back their debt.

How to avoid Student Loan Forgiveness Calls

Here are some tips for how to stay on top of your student loans and avoid being contacted by debt collectors about student loan forgiveness:

1. Track Your Loans

You should always keep track of all your loans through the student financial aid website maintained by the National Student Loan Data System (NSLDS).

If your loan has been discharged (forgiven) by the DOE or is currently in default, then ensure that information is recorded correctly so it can be easily accessed later when dealing with collection calls.

Check your credit report regularly and keep track of any errors or changes that take place. If anything seems amiss, contact the credit agency that reported the error and ask them to correct it.

If you’ve had a hard time paying back student loans, it might be worth looking into getting on track by monitoring your credit score regularly.

Credit scores like FICO and VantageScore provide helpful information about your credit history that can help determine whether or not there are problems with repayment schedules or late payments.

2. Know what type of loan you have and when it will be forgiven

If you have federal Stafford loans (also known as subsidized or subsidized Stafford), you can qualify for federal loan forgiveness after 20 years of repayment.

Private loans can also qualify for loan forgiveness after 10 years under certain circumstances; check with your lender to learn more about your situation.

3. Refusing to accept the offer

Another step to avoid student loan forgiveness calls is to refuse to accept the offer. You can do this by calling the lender directly and saying that you are uninterested in their offer.

Common Student Loan Forgiveness Scams

The student loan forgiveness scam is common, and it’s important to be aware of the tactics people use to trick you into paying them.

The following are some of the tactics used by student loan forgiveness scammers:

1. They ask for money upfront for services that never materialize and are not covered by your school’s financial aid office.

2. They claim that you can get your loans forgiven through an elaborate process, but they only send you monthly payments for a couple of years until the debt is paid in full.

3. They contact you via social media and claim to be from a government agency, such as the IRS or the Department of Education, asking for additional information about your account.

This will allow them to steal your personal information and take out more loans in your name than you originally applied for when applying for student loans online or at a financial aid office on campus during the application process.

4. Fake scholarship offers: People have received fake scholarships in the mail or on social media, promising they’ll pay off their student loans if they sign up for these scholarships and then write an essay about why they deserve the money.

5. Fake loan forgiveness letters: These letters look real enough that many assume they’re legitimate until they get one in the mail or read it online. They may even include fake references or signatures from actual universities or colleges.

The problem with these letters is that they’re usually presented as official documents issued by the U.S. Department of Education (ED). It’s almost impossible for ED to issue such and have student loans.

Common Legitimate Student Loan Forgiveness Companies

Income-Driven Repayment Forgiveness

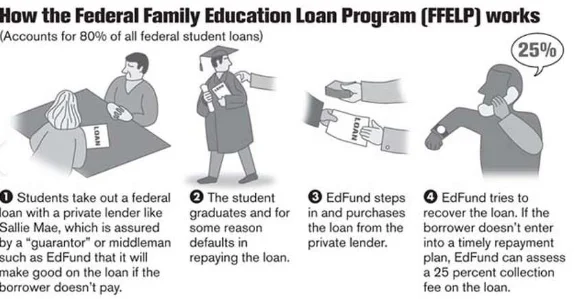

The Income-Driven Repayment (IDR) program offers forgiveness for loans made under the Federal Family Education Loan Program (FFELP).

Students eligible for IDR may have their remaining loan balance forgiven after ten years of on-time payments, provided they continue to make 120 monthly payments from month to month.

Student Loan Assistance Corporation (SLAC)

Student Loan Assistance Corporation is a non-profit organization that helps borrowers with Perkins loans by offering free legal assistance and counseling services.

If you qualify for help from SLAC, they will work with you on filing paperwork and reaching out to lenders on your behalf so that they can negotiate a reduced payment or complete forgiveness of the loan balance.

Perkins Loan Cancellation and Discharge

Perkins loan forgiveness is a program that offers students the opportunity to have their Perkins loans discharged. You can cancel your Perkins Loan in different ways, depending on your circumstances.

You could apply for cancellation if your school closed before you graduated or were dismissed. If dismissed, you could apply for discharge after three years of active military service.

If you withdrew from school or did not graduate within six months of your program’s end, the loan will be forgiven after 120 days.

The Public Service Loan Forgiveness (PSLF)

PSLF program is the federal government’s way of helping you pay off your student loans. The PSLF program forgives your remaining loan balance after 120 payments.

If you meet all the requirements, your remaining loans can be forgiven after making 120 on-time payments under an income-driven repayment plan.